Monitoring the Metrics

Navigating the Current Economy: Interest Rates, Economic Health, and What Lies Ahead

As the Federal Reserve elected to maintain the current federal funds rate target at their meeting on November 1, Americans face a changing landscape shaped by high and potentially still rising interest rates and a robust economy. Understanding the implications of these changes may help consumers and companies prepare for what lies ahead.

A Strong Economy

Recent data shows a U.S. economy exhibiting more strength than previously expected. The number of job openings at U.S. companies unexpectedly surged this summer and has remained steady, a reflection of the continued resilience of the labor market. This has been coupled with inflation readings that are cooler than what was previously predicted, yet above the Federal Reserve’s 2% inflation target. Expectations of the unemployment rate at the end of 2023 have been revised from 4.1% in June to 3.8% in September, and the unemployment rate is now projected to be lower than expected in 2024. Real GDP is now expected to grow by 1.5% in 2024 and by 2.4% in 2025.

Interest Rates on the Rise

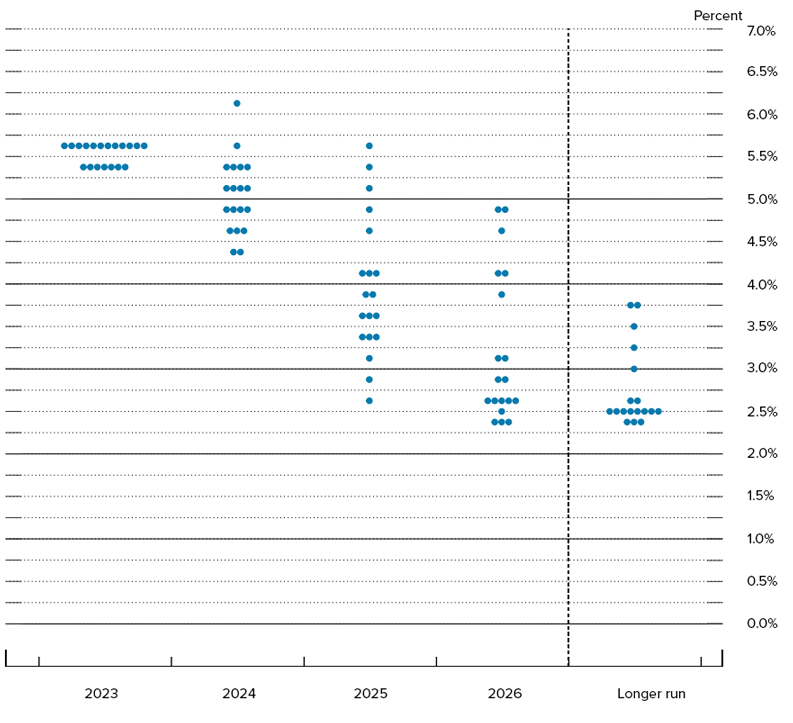

Federal Reserve officials chose to keep interest rates unchanged – ranging between 5.25% and 5.5% and at a 22-year peak – at their November meeting and are considering potential future increases. This decision reflects a division within the Fed, with most officials, 12 of 19, leaning toward another rate hike. This comes after a rapid series of rate hikes over the last 18 months aimed at tamping down inflation. Fed Chair Jerome Powell emphasized the need to see more data before deciding on another rate adjustment. Most officials predict that interest rates might stay near their current level through next year, and the median projection suggests a small reduction of the fed funds rate to approximately 5% by the end of 2024.

Note: The Fed dot-plot shows the expectations on monetary policy of each Fed board official.

Source: Federal Reserve Summary of Economic Projections, September 20, 2023

The average investor, according to the CME FedWatch Tool, expects the Federal Reserve to hold interest rates steady through May 2024. However, this expectation conceals a significant amount of disagreement, mirroring the current division within the Fed. On October 3, almost 40% of market participants believed there would be a rate hike of 0.25% in the December Fed meeting. At the beginning of the year, and even on June 1, investors anticipated the fed funds rate to be 50 basis points lower than the current target. This earlier view highlights some investor over-optimism at the start of the year, but also a reaction to recent stronger-than-expected economic data. In contrast, the Fed board has maintained a prudent and consistent view since the beginning of the year, expecting interest rates to remain high throughout 2024.

Note: The graph depicts the contrasting investors’ view of the December 2023’s target fed funds rate in June versus October. The blue bars show the market’s view on June 1, and the orange bars show the investor’s view on October 3.

Source: CME FedWatch Tool

Higher fed funds rates come hand-in-hand with climbing interest rates in different markets. A recent unanticipated surge in long-term bond yield rates to 16-year highs is raising concerns in the financial markets. The yields on the 10-year Treasury note experienced a jump, reaching 4.801% – a level not seen since the onset of the subprime mortgage crisis in August 2007. Escalating bond selloffs have shaken Wall Street confidence, erasing, as of October 3, the Dow Jones Industrial Average's gains for the year.

The Consumer Perspective

Borrowers are feeling the pinch in consumer lending markets. Those looking to buy homes or cars find that their money doesn't stretch as far as in prior years. Two years ago, 30-year fixed-rate mortgages floated around 3%. Today, mortgage rates stand over 7%, translating to hundreds of dollars in additional monthly payments for home buyers. Car loans have seen similar jumps.

For many, this increase in borrowing costs clashes with already high prices, pushing essential purchases, such as cars and homes, out of reach. According to Moody's Analytics' chief economist, Mark Zandi, these purchases are "completely unaffordable for the typical American household."

The rising energy prices, particularly oil, are also concerning. As oil producers reduce supply, consumers are seeing increased costs at the pump and, indirectly, across various sectors, from transportation to groceries. The ripple effect of rising diesel, jet, and marine fuel prices can lead to escalated costs in everyday essentials like food and construction materials, impacting household budgets and discretionary spending.

Corporations adjusting to the new economic climate can influence consumers. As companies prioritize debt reduction, consumers might witness changes in pricing, product availability, or promotional offerings. On the other hand, as brands recognize changing consumer trends toward value, they are offering bulk-buy options, which could indicate a broader market shift toward catering to budget-conscious consumers.

The Banking Perspective

The rise in interest rates poses significant risks to the U.S. banking sector, affecting both their assets and liabilities. Rising interest rates have directly impacted the unrealized losses on the bonds and loans held by banks. When yields rise, the value of existing fixed-rate bonds and loans fall, leading to unrealized losses. This is particularly concerning as, in extreme cases, these losses have matched or even surpassed banks’ equity. Such scenarios already led to the collapse of three regional banks earlier this year.

Some banks have proactively managed their risks by reducing their bond holdings, either letting them mature without reinvesting or even selling them at a loss to prevent larger future losses. Such steps, while painful in the short term, might be prudent to avoid potential larger losses in a rising interest rate environment. These painful measures might explain why the U.S. banking sector remains resilient.

Aiming for a Soft Landing

Historically, achieving a soft landing – where interest-rate hikes manage inflation without inducing a recession – has been a challenging feat. However, the recent easing of inflation in 2023 has raised hopes among economists and Federal Reserve officials that this might be attainable.

Yet, achieving this delicate balance requires luck, timing, and precision. The hope is to replicate the success of 1995 – the only instance since World War II where a soft landing was achieved. But as Alan Blinder, the Fed vice chair from 1994-96, notes, “We steered the economy very expertly, but in addition, we were lucky. Nothing bad happened.”

The current U.S. economy faces several challenges to replicate the 1995 soft landing. Surging oil prices threaten to increase inflation while stifling growth. Additionally, broader macroeconomic factors, such as a continuing workers’ strike, looming government shutdown, and the resumption of student loan payments, add to the complexity. While employment data shows resilience in job openings, the broader market depicts a more cautious stance, as shown by many investors increasingly hoarding cash.

Looking Ahead

The Federal Reserve has indicated its intention to keep interest rates high through 2024. The median projection from Fed officials suggests a small reduction of the fed funds rate to approximately 5% by the end of 2024. Fed officials continue to express confidence in achieving their 2% inflation goal without causing a significant economic downturn. Investors remain slightly more optimistic about the path of interest rates than the Fed board. Their optimism has waned since June, when they projected the fed funds rate to be around 3.75% by the end of 2024. Now, their expectations align more closely with those of the Fed.

Note: The graph depicts the contrasting investors’ view of the December 2024’s target fed funds rate in June versus October. The blue bars show the market’s view on June 15, and the orange bars show the investor’s view on October 3.

Source: CME FedWatch Tool

Consumers and businesses must brace themselves for a continued era of expensive borrowing and potentially volatile inflation. Investors are facing concerns about potential inflation volatility in the global economy, as some forces that previously ensured low inflation and interest rates – globalization and abundant cheap energy – remain weakened. There is also growing uncertainty in the bond markets. The Federal Reserve, after purchasing trillions of securities to provide economic stimulus over past years, stopped its purchases in 2022 and has been passively reducing its holdings. This change might have led to unexpected correlations between stocks and bonds.

The Data to Watch

The key data to monitor are the inflation reports. The Fed hopes to see a cooling of service prices and a moderation in housing prices. Currently, energy prices are rising, which could further elevate headline inflation figures. Yet, the Fed might be inclined to overlook short-term fluctuations in energy prices. Jobs data is also critical. Fed board members are sensitive to hot labor markets as they curb the path of inflation to the Fed’s 2% target rate.

Final Thoughts

We are likely nearing the peak of this interest rate cycle. However, if forthcoming economic data does not reassure the Fed that inflation is returning to its 2% target, they might begin to hint at another interest rate increase. That could be the last hike of this cycle. Alternatively, if upcoming economic data shows a cooler labor market and economic growth aligned with the Fed’s expectations, the final increase may have already taken place in July.